Financial Products

|

Type of Product |

SAVINGS ACCOUNT (bank); SHARE ACCOUNT (credit union) |

|

Minimum Initial Deposit |

Usually $25-100 but make certain monthly fees are not charged for small balances |

|

Yield |

Usually 0.2-0.5% |

|

Safety |

Government-insured* |

|

Access to Funds |

Immediate |

|

Where to Purchase |

At any bank, thrift, or credit union |

|

How to Purchase |

In person, online, or by phone |

|

How to Make Deposits |

Through tellers, ATMs, or automatic monthly transfer from checking account |

|

Other Features |

At many institutions, minimum balance of $100-500 is required to avoid monthly fees or automatic transfers of $5 - $25 a month. |

| Type of Product | Online Savings Account |

| Minimum Initial Deposit | As low as $1 at some institutions |

| Yield | Usually 0.10-2.0% |

| Safety | Government-insured* |

| Access to Funds | Immediate |

| Where to Purchase | At any bank, thrift, or credit union |

| How to Purchase | In person, online, or by phone |

| How to Make Deposits | By transferring money from a checking account, or through direct deposit. |

| Other Features | Confirm that the online institution is insured. |

| Type of Product | CERTIFICATE OF DEPOSIT (bank); SHARE CERTIFICATE (credit union) |

| Minimum Initial Deposit | At most institutions, at least $500 |

| Yield | Usually 0.05-1.5% |

| Safety | Government-insured* |

| Access to Funds | Immediate but interest penalty |

| Where to Purchase | At any bank, thrift, or credit union |

| How to Purchase | In person, online, or by phone |

| Other Features | Certain financial institution will notify you when CD matures |

| Type of Product | U.S. SAVINGS BOND, SERIES EE |

|

Minimum Initial Deposit |

As low as $25 ($50 for payroll deduction) |

|

Yield |

Usually 1.5% |

|

Safety |

Government-guaranteed |

|

Access to Funds |

After first 12 months, immediate access but loss of 3 months interest |

|

Where to Purchase |

The U.S. Treasury www.treasurydirect.gov |

|

How to Purchase |

Through www.treasurydirect.gov where savers can buy electronic (no paper) savings bonds for themselves or as gifts for others. |

|

How to Make Deposits |

www.treasurydirect.gov allows periodic deposit or checking account deductions to purchase bonds |

|

Other Features |

Cash in after 30 years (no more interest earned after held 30 years) |

| Type of Product | U.S. SAVINGS BOND, SERIES I (with inflation protection) |

|

Minimum Initial Deposit |

As low as $25 |

|

Yield |

Usually 0-2% |

| Safety | Government-guaranteed |

|

Access to Funds |

After first 12 months, immediate access but loss of 3 months interest |

|

Where to Purchase |

The U.S. Treasurywww.treasurydirect.gov |

|

How to Purchase |

Through www.treasurydirect.gov where savers can buy electronic (no paper) savings bonds for themselves or as gifts for others. |

|

How to Make Deposits |

www.treasurydirect.gov allows periodic deposit or checking account deductions to purchase bonds |

|

Other Features |

Cash in after 30 years (no more interest earned after held 30 years) |

|

Type of Product |

Money Market Account |

|

Minimum Initial Deposit |

As low as $250 at some institutions |

|

Yield |

Usually 0.10-2.0% |

|

Safety |

Government-insured* |

|

Access to Funds |

Immediate access |

|

Where to Purchase |

In person, online, or by phone |

|

How to Purchase |

Ask for a Money Market Account |

* Accounts at some credit unions are privately insured.

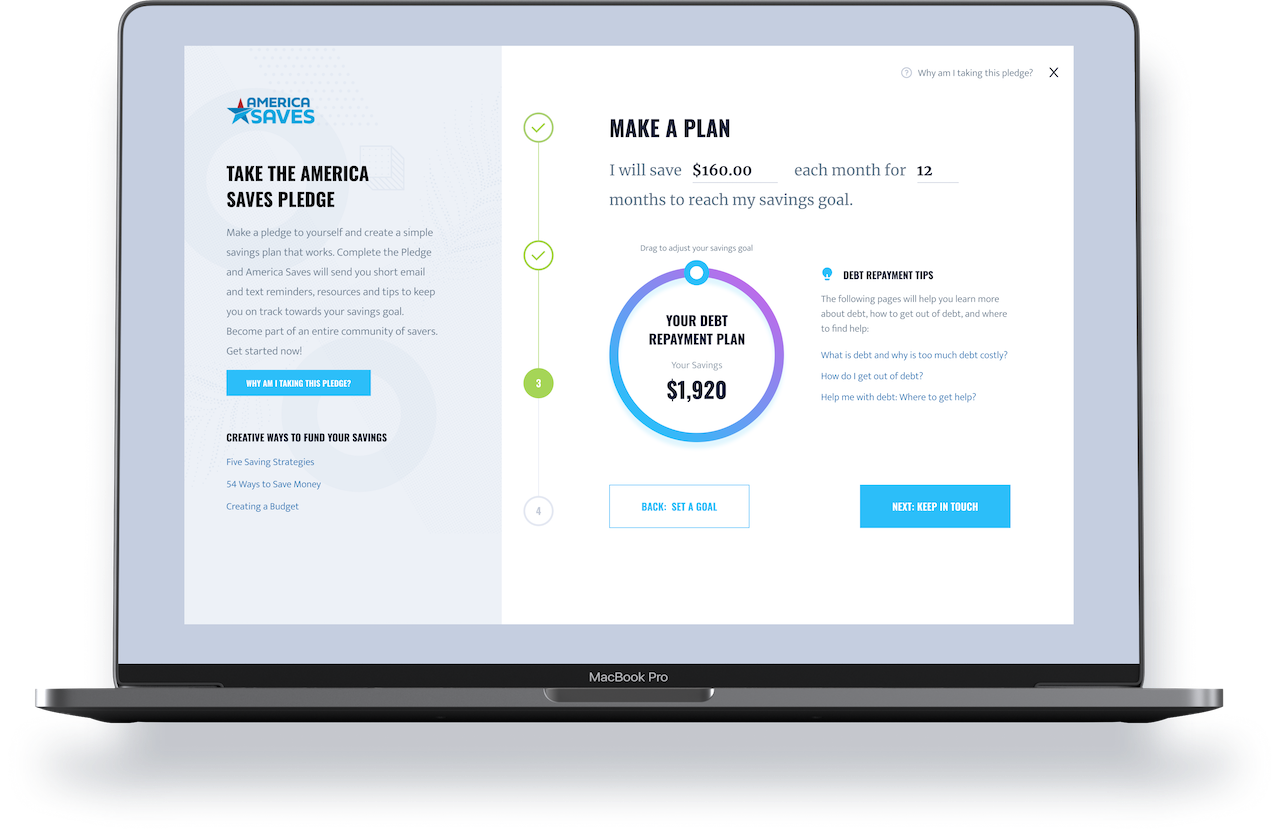

Take the Military Saves Pledge

Want inspiration and motivation on your savings journey? Take the Military Saves Pledge today and create a simple personal savings plan that works!

Take the Military Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Military Saves Pledge is a pledge to yourself to start a savings journey and Military Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

General - Savers Checklist

Check out the #savings checklist tool containing 15 “savings accomplishments” to assess your savings effectiveness: https://bit.ly/2fdv5O2

Check out savings journeys from savers just like you

Saver Stories save automatically Save as a Family

Making Saving Automatic Leads to Personal Success

05.27.2020

Ryan’s savings journey started when he was an active duty airman. Frequent deployments and temporary duty assignments gave him the opportunity to save. By the time he transitioned out of active duty, he had built up a healthy rainy-day fund and had started to aggressively save for retirement.

How Smart Financial Decisions Can Create Opportunities

11.22.2019

Written by Stephen Ross, America Saves Program Coordinator | November 22, 2019

Automatic Savings Retirement Homeownership Savings Military Spouse Military Saves Pledge Travel Large Purchase Six-Figure Savings automatic transfers Military Income Navy Navy Spouse Stack Your Dollars Spending And Savings Tool Military Money

Building a Six-Figure Savings While Enjoying Life

11.13.2020

Does the idea of saving up hundreds of thousands of dollars seem impossible? How about doing it while sti...

Involving Kids in Family Finances

04.19.2019

One of the best lessons we can share with our kids is about money. By middle school, kids should have a g...

Living the Dream: This Military Couple Retired Early

03.18.2021

“Continuous dedication to financial peace pays off,” shares military couple, Denise and Jim. They would k...

or

If we feature you in our newsletter, you get $50.