Saving on a Tight Budget

How can those who currently aren’t saving afford to save money? And how can those saving only a little save more?

Here are our top 10 tips for saving money when budgets are tight.

Cut Spending Painlessly

Tip 1: To find small savings that add up to big savings over time, keep a careful record of all (and we mean all) of your expenditures for a month. You may be surprised to learn how much you are spending on such things as a daily latte or restaurant meals.

Tip 2: For necessary purchases — such as food and transportation and insurance— comparison shop. Remember your Commissary and Exchange can offer you savings year-round. Utilize these savings opportunities as you would your other military benefits.

Tip 3: Restrain spending on birthdays and holidays, especially Christmas. A few well-chosen gifts are likely to be more appreciated than a more costly pile of gifts chosen thoughtlessly in a shopping mall foray.

Reduce High-Cost Debt

Tip 4: Interest rates on credit card debts and other retail credit lines can easily run 25 percent. You can save hundreds, perhaps thousands, of dollars a year by paying off these high-cost debts. If you are located at a military installation you can get assistance at the Family Readiness Center for free. Personal Financial Managers and Counselors are there to help and can be a great asset in getting a debt repayment plan in order. Another resource is MilitaryOneSource (1-800-342-9647) they also offer free financial counseling.

- Learn more about how to get out of debt.

Save For Emergencies

Tip 5: Build an emergency fund to avoid having to take loans to pay for unexpected purchases. That fund is usually best kept in a separate savings account, despite the low interest rates such accounts pay right now. But do try to keep a high enough balance in the account to avoid monthly fees. Many on-base banks and credit unions participate in Military Saves Month and offer great savings options during the Month and throughout the year. To learn more on emergency savings, click here.

Tip 6: Set up an automatic transfer each pay period or month from your checking to your savings account or through an allotment. Even as little as $10 or $15 a month helps. After all, that’s $120 or $180 a year.

Tip 7: Put all your loose change in your savings account. For many people, that could add up to well over $100 a year.

Take Free Money and Save it

Tip 8: Low- and moderate-income workers qualify, each year, for an Earned Income Tax Credit that can put over $1,000, and often more than $2,000, in your pocket. The EITC Assistant tool provided by the IRS can help you determine if you qualify to claim the credit, or you can contact your local tax payer assistance center for in-person help. Then be sure to save at least half of this windfall.

Tip 9: Participate in a local Individual Development Account (IDA) program. In return for attending financial education sessions and agreeing to save for a home, education, or business, you typically receive $2 for every $1 you save through an IDA program. So, $25 that you save each month ends up as $900 at the end of a year.

Tip 10: Participate in the Thrift Savings Plan or Save at Work. While we encourage letting this money build up until retirement, it can be withdrawn, or borrowed on, to cope with serious emergencies.

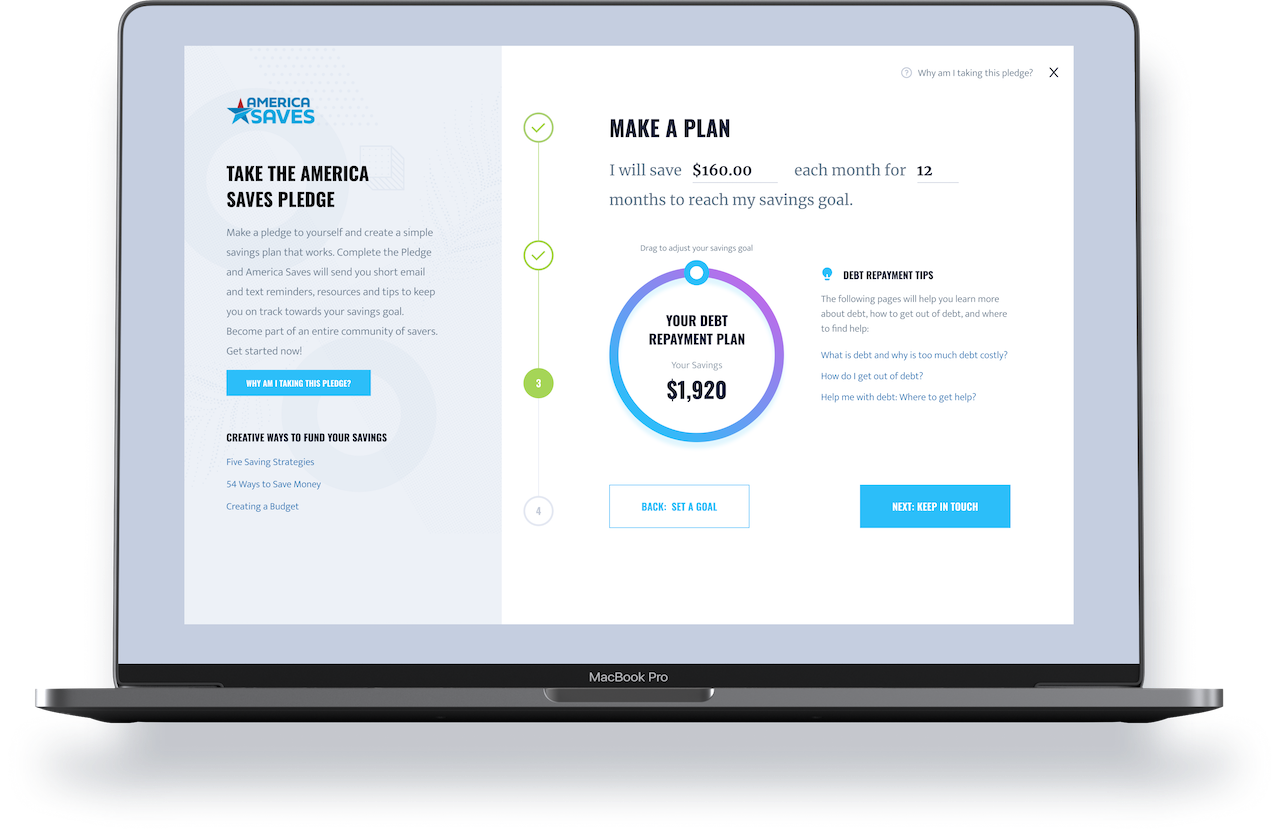

Take the Military Saves Pledge

Want inspiration and motivation on your savings journey? Take the Military Saves Pledge today and create a simple personal savings plan that works!

Take the Military Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Military Saves Pledge is a pledge to yourself to start a savings journey and Military Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

General - Take the Pledge

Are you ready to set your #savings goal and make a plan to achieve it? Take the Military Saves Pledge today http://ow.ly/C7sGZ

Check out savings journeys from savers just like you

Setting a Goal Leads to Success

05.24.2019

Growing up, Marisa’s dad had always talked about saving first, but she said she didn’t really internalize it until much later. “I was drifting along with no plan, carrying a little bit of revolving debt, saving some money here and there, but without a real plan for it.”

How Smart Financial Decisions Can Create Opportunities

11.22.2019

Written by Stephen Ross, America Saves Program Coordinator | November 22, 2019

When You Start Small, Saving is Easy

08.12.2019

When Attiyya first got married, she and her Marine husband had just graduated from college and were focus...

Automatic Savings Retirement Homeownership Savings Military Spouse Military Saves Pledge Travel Large Purchase Six-Figure Savings automatic transfers Military Income Navy Navy Spouse Stack Your Dollars Spending And Savings Tool Military Money

Building a Six-Figure Savings While Enjoying Life

11.13.2020

Does the idea of saving up hundreds of thousands of dollars seem impossible? How about doing it while sti...

Credit Score Shopping Online Scams Homeownership Savings Military Saves Pledge large purchases Military Income Navy Spending And Savings Tool Military Money Shopaholic self-care catfish emotional spending self-respect self-love

From Shopaholic to Saver

01.13.2021

Many of us spend too much money on things we don’t need, but we don’t always know why. It’s easy to get a...

or

If we feature you in our newsletter, you get $50.