Five Saving Strategies

1. Save for emergencies

Having an emergency savings fund may be the most important difference between those who manage to stay afloat and those who are sinking financially.

2. Pay off High Cost Debt

The best investment most borrowers can make is to pay off consumer debt with double-digit interest rates. For example, if you have a $3,000 credit card balance at 19.8%, and you pay the required minimum balance of 2% of the balance or $15, whichever is greater, it will take 39 years to pay off the loan. With accumulating interest, you will pay more than $10,000 in interest charges.

For additional information, see the National Foundation for Credit Counseling website at www.debtadvice.org.

3. Save automatically using an allotment with myPay

These savings will provide funds for emergencies, future consumer purchases, home purchase, school tuition, or even retirement (also see Tip #4). You can use one (or more) of your six discretionary allotments to automatically transfer funds monthly from your into a savings account. Saving automatically is the easiest and most successful way to save. What you don't see, you will probably not miss.

The people of the Defense Finance and Accounting Service (DFAS) take pride in serving the men and women who defend America. We take our contributions to national defense seriously. We work hard to fulfill the important fiscal responsibilities entrusted to us by the American taxpayers.

For additional information, click here.

4. Participate in the Thrift Savings Plan

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready Reserve. It was established by Congress in the Federal Employees' Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans.

For additional information, click here. Don't forget to have your spouse or family member save for their retirement as well. Click here for more information on saving for retirement.

5. Deploying? Take advantage of the Savings Deposit Program

A total of $10,000 may be deposited during each deployment and will earn 10% interest annually. You cannot close your account until you have left the combat zone, although your money will continue to draw interest for 90 days once you’ve returned home or to your permanent duty station.

For additional on the Savings Deposit Program, click here.

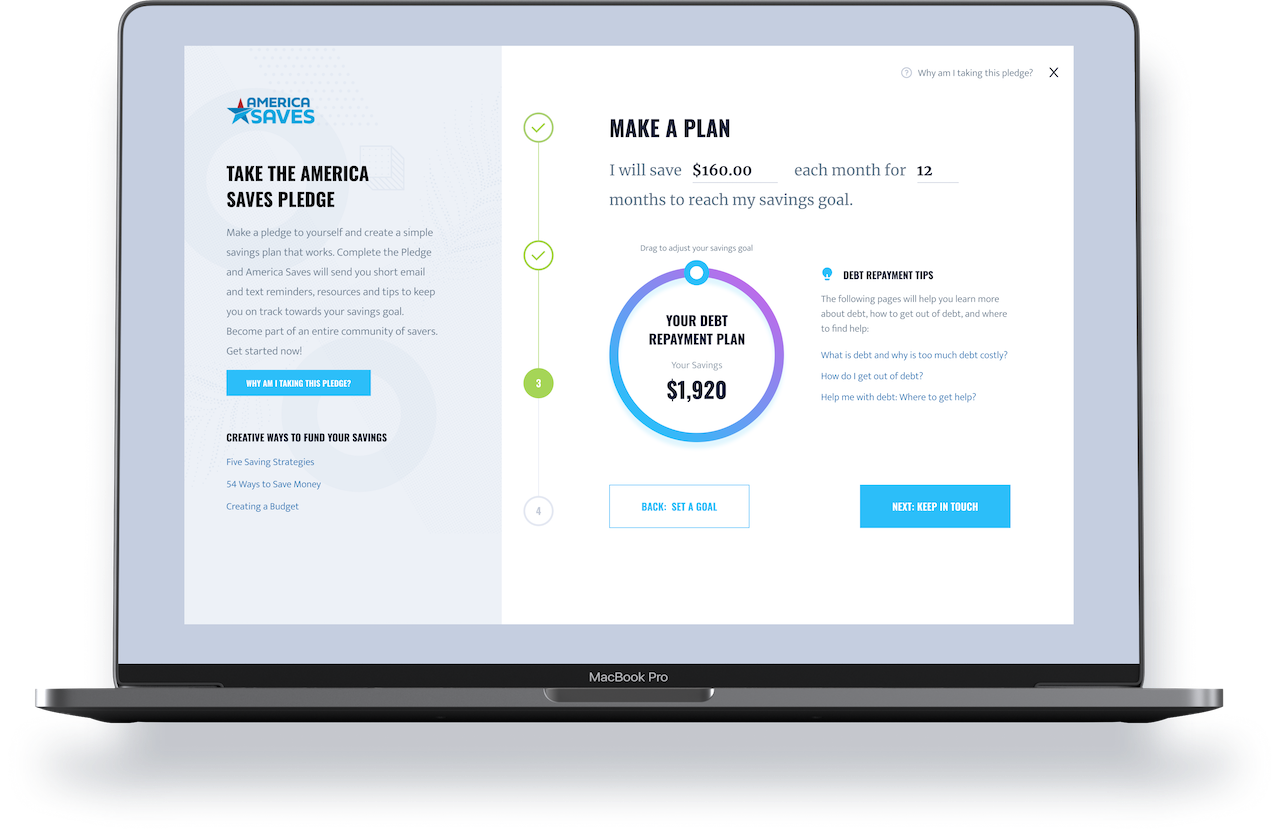

Take the Military Saves Pledge

Want inspiration and motivation on your savings journey? Take the Military Saves Pledge today and create a simple personal savings plan that works!

Take the Military Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Military Saves Pledge is a pledge to yourself to start a savings journey and Military Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

General - TSP

The Thrift Savings Plan (TSP) offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. Sign up or get more info at tsp.gov

Check out savings journeys from savers just like you

Involving Kids in Family Finances

04.19.2019

One of the best lessons we can share with our kids is about money. By middle school, kids should have a good understanding of how money works as well as the importance of saving.

Living the Dream: This Military Couple Retired Early

03.18.2021

“Continuous dedication to financial peace pays off,” shares military couple, Denise and Jim. They would k...

Setting a Goal Leads to Success

05.24.2019

Growing up, Marisa’s dad had always talked about saving first, but she said she didn’t really internalize...

How Smart Financial Decisions Can Create Opportunities

11.22.2019

Written by Stephen Ross, America Saves Program Coordinator | November 22, 2019

Saver Stories save automatically Save as a Family

Making Saving Automatic Leads to Personal Success

05.27.2020

Ryan’s savings journey started when he was an active duty airman. Frequent deployments and temporary duty...

or

If we feature you in our newsletter, you get $50.