Set a Goal, Make a Plan and Save with Military Saves!

Saving money, improving your financial life, building wealth. It all starts when you set a goal and make a plan to reach that goal. So what is your goal? Set up an emergency cash fund? Get out of debt? Make a down payment on a car or home? Sock away money for college or retirement?

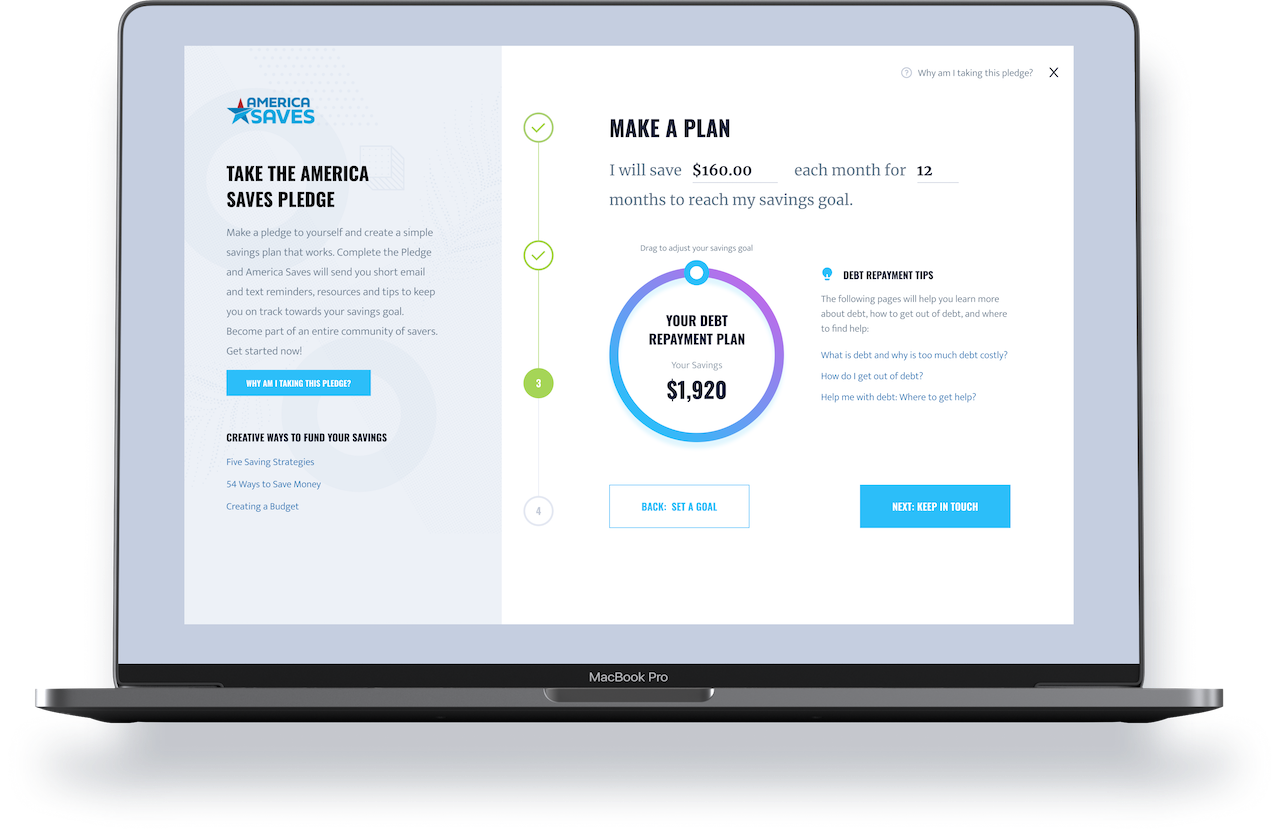

Take the Military Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Military Saves Pledge is a pledge to yourself to start a savings journey and Military Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

WHAT ARE YOU SAVING FOR?

Depending on your goal your approach to saving changes! Choose a topic to explore and learn more about how to save successfully and effectively in that specific area.

Do you have a saving tip or story you want to share with us?

If we feature your story or tip, you get $50.

TAKE THE MILITARY SAVES PLEDGE

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and America Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now!

Take the Military Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Military Saves Pledge is a pledge to yourself to start a savings journey and Military Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Savings Insights

COVID-19 Resources

Military Saves is committed to ensuring military families have the information they need for their well-being. Here is a list of savings resources to help during the COVID-19 (Coronavirus) crisis. This page is being updated as new resources come in.

04.09.2021

Your TSP: How to Make Your Money Work For You

Written by Cloud Spurlock, Federal Retirement Thrift Investment Board | April 9, 2021

03.26.2021

It’s Time for Your Check-Up; Your FINANCIAL Check-Up

You probably do routine maintenance on your car – get the oil changed, filters checked, and have the tires rotated. And you probably make sure you go to the doctor and have a physical every year or so. But do you ever take the time to do a financial well-check?

03.18.2021

Living the Dream: This Military Couple Retired Early

“Continuous dedication to financial peace pays off,” shares military couple, Denise and Jim. They would know, because at ages 52 and 53, they are already retired. The couple enjoyed life as an Army family for 32 and a half years and started planning for retirement decades ago. Denise shares, “We are not working a paid job, but are volunteering and meeting some personal fitness goals and enjoying some time together after many years spent geographically apart. It can be done!”

01.25.2021

Five Things to Keep in Mind this Tax Season

Is it really that time of year again? I admit it: I dread tax season. I hate gathering my paperwork, tracking down my W2, making sure I have all my interest and dividend statements. Taxes will never be something I enjoy, but at least I can be prepared. Here are five things to help get you ready for this year’s tax season.

01.13.2021

What You Need to Know About Payroll Tax Deferral Repayment

Last fall, we talked about the that affected most military members and many federal employees. The deferral equated to a four-month, 6.2% increase in pay. But the catch was that it was just a temporary boost and needed to be repaid in 2021. Well, the time to repay those taxes has arrived, and here is what you need to know before the first pay period of the year.

01.13.2021

From Shopaholic to Saver

Many of us spend too much money on things we don’t need, but we don’t always know why. It’s easy to get a quick fix from retail therapy, but before we know it, our hard-earned money is gone. Oftentimes, when we engage in a “shopaholic” lifestyle or sporadic shopping sprees, we still experience feelings of emptiness, but to make it worse, we now have debt, too.

01.04.2021

Ten Great Ways to Spend Your Second Stimulus Check

The federal government has started sending out the second round of stimulus checks (more formally called Economic Impact Payments). These may be the final round of payments to go out, so having a plan in place is key.

12.11.2020

Three Things About Money That I Learned from Hallmark Movies

The leaves have fallen, the air is crisp, and the flavors have shifted from pumpkin spice to peppermint mocha. Yes, it’s winter and time for the television programming lineup to be filled with movies that have improbable plot twists and lots of foreign princes. Yet aside from the epically decorated houses, the fake snow, and the cheesy love stories, you can actually learn some money lessons from these holiday flicks.

11.13.2020

Building a Six-Figure Savings While Enjoying Life

Does the idea of saving up hundreds of thousands of dollars seem impossible? How about doing it while still living an enjoyable lifestyle?

Partner Resource Packets

We know that the hard work of getting people to change their financial behavior takes time, which is why Military Saves wants to assist your efforts to encourage financial action and savings behavior change throughout the year.

View the Latest Partner Resource Packets

Want to share savings messages? Our Partner Resources Packets include blog, social media, and other content.

By MyArmyBenefits Team

Life After Retirement: Will You Have Enough?

This month we are highlighting a partner resource. MyArmyBenefits is the U.S. Army’s official benefits website and is geared toward all components: Active, Guard, and Reserve.

Like Us on Facebook

Follow Us on Twitter

General - Save Automatically

#Save automatically using an allotment with #myPay to automatically transfer funds monthly into a #savings account http://ow.ly/sGWxb

Want to receive the latest info from America Saves?

For Savers

For Savers

For Organizations

For Organizations